How To Use GCredit: A Detailed And Simple Instruction

Have you ever heard of GCredit? It is a personal revolving credit line that supports qualified GCash users for instant, no-approval loans. Thanks to this payment, you can borrow a limited amount of money for urgent financial needs, like when you pay your phone bill. But do you know how to use GCredit? Do not worry if you do not. Please read our article below to get further information.

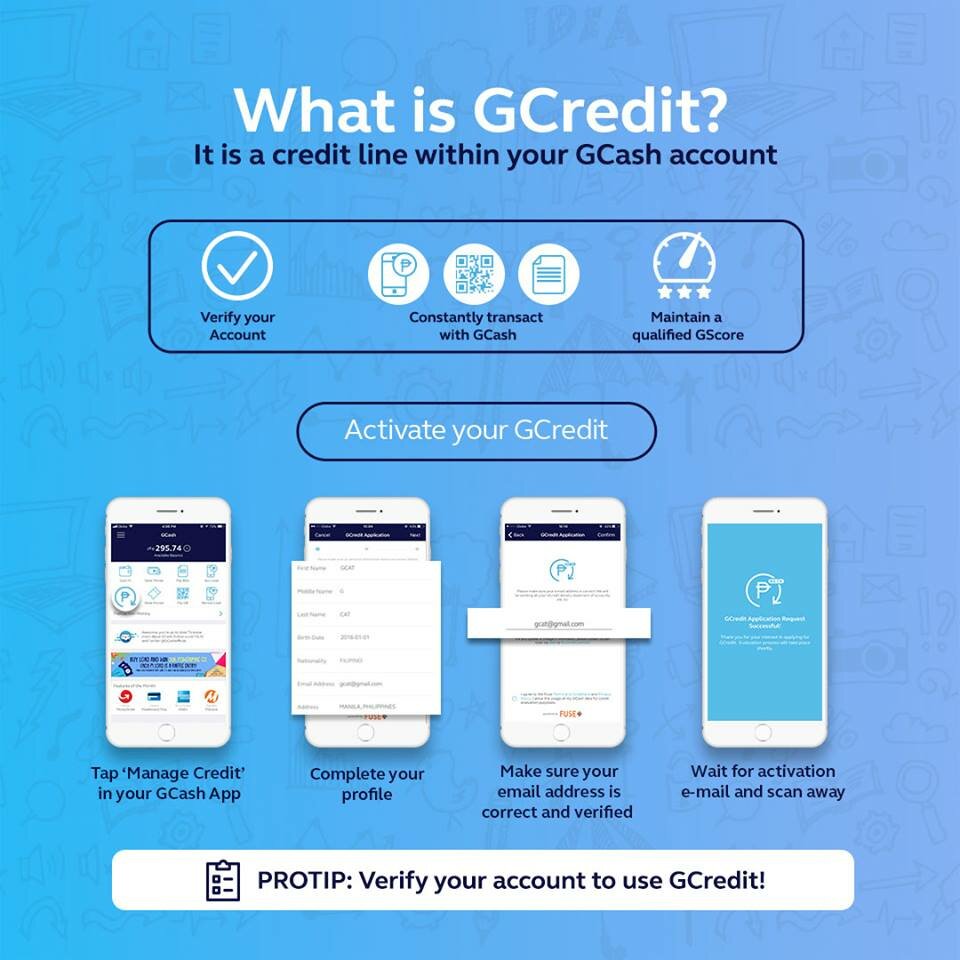

What Is GCredit? How To Use GCredit In GCash

Let’s go into the details of what GCredit is. It works as a flexible loan or credit card. As we have mentioned above, you can borrow a set limit of money to serve your urgent needs.

It is worth mentioning that you get a credit limit, and you can use it freely as long as the total loan amount does not exceed the limit. Of course, you can make the most of many loans at the same time. Besides, you will have borrowed your maximum credit limit once you have paid off your previous availments.

Let us take an example. You can avail your GCredit limit of P1000. You bought shoes worth P400, and now you only avail P600 for the next payment. But you can then again avail up to P1000 if you pay the previous P400 of your GCredit balance.

For more information, your credit limit is based on your individual GScore, which means a rating of your transactions in GCash. High GScore will make you have a high credit limit. To do this, let’s do more GCash transactions, such as paying bills, cash-ins, buying prepaid load, investing money, paying off your loans early, and so on.

Now, we are going to show you how to use GCredit in GCash. Scroll down now!

How To Use GCredit To Bank Transfer

One of the benefits that GCredit brings to users is bank transferring. You do not have to come to the bank and transfer an amount of money to your friends, especially when you are in an urge. But how to use GCredit to bank transfer? The process is quite simple.

First, open the GCash app and tap on the “Send to Bank” icon. After choosing the desired name of the bank, you will provide the receiver’s account name, his/her number and enter the amount to transfer. Click “Send Money” afterward, and you have done the transaction.

Do not worry if the receiver does not have a GCash account yet. GCash supports you to send money to any partner bank.

Now you have figured out how to use GCredit to send money, how about other actions? Let’s move to the next part. If you want to enjoy the benefits of a GCash Mastercard, here is how to get GCash card.

How To Use GCredit To Buy Load

Here is how to use GCredit to buy load.

In the GCash app, you will see the icon “Buy Load”, then click on it. Continue entering the mobile number that you tend to load up. Moreover, you can select the desired one from the phonebook and click “Next”.

After that, enter a value you want or select from the provided denominations, confirm once again before completing the transaction.

With this feature, you can load up any mobile number from any network without going to the nearest convenience store. How convenient it is!

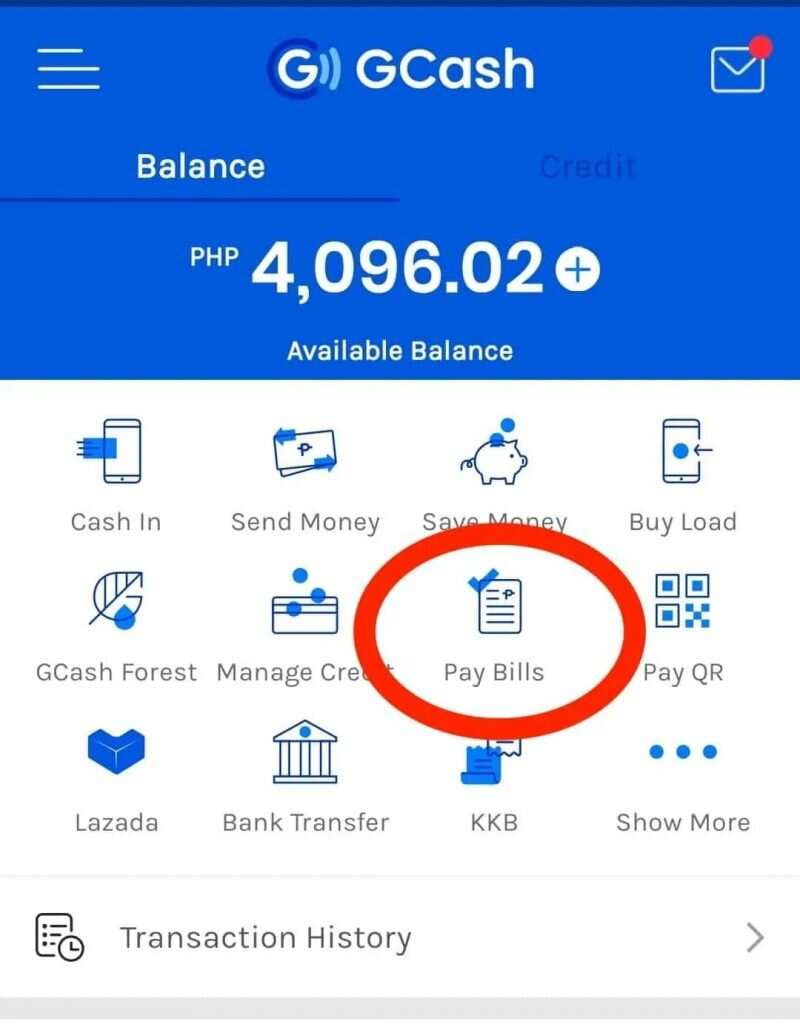

How To Use GCredit To Pay Bills

The way of how to use GCredit to pay bills is as similar as the two above methods.

First, you have to determine whether your billers on GCash allow for GCredit as bills payment or not. If yes, let’s tap “Pay Bills” on the GCash app and choose the appropriate biller that you want to settle with.

Then, fill in the required details, including account name, email, and amount of money. After clicking “Next”, you have to choose “GCredit” as the payment source. Remember that your bill amount must be equal or lower than your maximum credit limit.

On top of that, some billers include a service fee in your principal loan amount. That’s why some principal payments are sometimes higher than your paid bill.

You have to check your details once again before pressing “Confirm” to pay bills. And you will get text and email notifications of a successful bill payment afterward.

You can add some billers to your “Favorites” by tapping a heart sign beside their names to save time while paying bills in the future.

>>> Lasted update: Toyota Philippines car price

In Conclusion

We do hope that our article on how to use GCredit above has broadened your knowledge and supported the payment of your personal expenses better.

We have to emphasize that once you avail of a GCredit loan, do not forget to pay your dues early to obtain other loans in the future effortlessly. It’s time to take full advantage of GCredit. Good luck! For more how-to articles like this, please visit TechiestuffPh.com.